Indian rupee has seen depreciation in the last 3 months at a rate that has confused most of the market players and analysts. If we think rationally, looking to the deep financial crisis in the USA, the value of USD should depreciate against the currencies of the countries with sound financial systems that are less impacted by the global turmoil. But ironically, INR has depreciated by more than 23 per cent in the last 9 months.

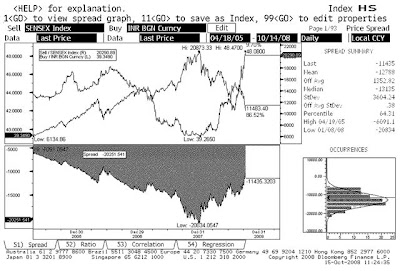

There may be many reasons for the depreciation in the Indian Rupee, but if we analyze the movement of SENSEX vis a vis INR, we found some pattern in the movement. The SENSEX touched a record high of 20873.33 on 8th January 2008 and INR touched a record low of 39.2650 on 15th January 2008. It is quite evident that the sentiment in the Indian Equity market became very bullish after the FII funds inflows were very strong and SENSEX rose from a level of 4500 in early 2004 to 20800 in January 2008 (Less than 4 years). But due to the current Financial Market Crisis, the FII flows have reversed and an outflow of Rs 37000 crore was done from the Indian Equity market . FIIs have been the drivers of the market till now, and they will be the crucial in future too. Since January this year, Rupee has also started depreciating and main reason for the currency movement can be attributed to the loss of confidence in the equity market and the resulting FII outflow.

Comments